Is a Shell Company Illegal in Singapore? The $3 Billion Wake-Up Call for 2026

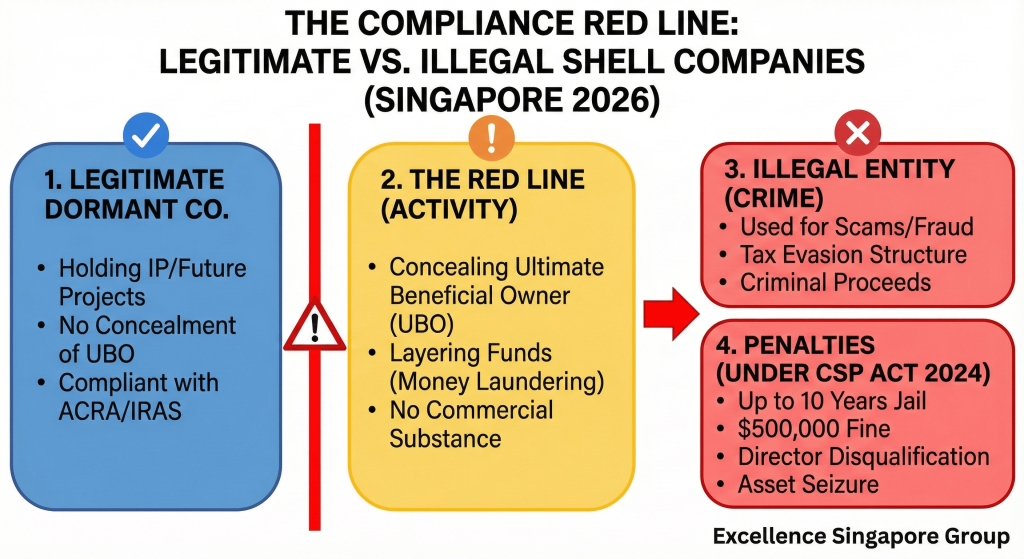

In Singapore’s business landscape, the term “Shell Company” is often misunderstood. Some see it as a convenient holding tool, while others see it as a red flag for crime.

With the recent $3 billion money laundering scandal—Singapore’s largest to date—regulatory bodies like ACRA and the Monetary Authority of Singapore (MAS) have significantly tightened the noose around “paper companies.”

If you are a director or shareholder, you need to understand exactly when a “shell” becomes an “illegal entity.”

1. The Legal Truth: Shell vs. Illegal

To be clear: A shell company is not inherently illegal in Singapore. Many legitimate businesses use “dormant” or “shelf” companies for future projects, holding intellectual property, or facilitating mergers.

However, a company becomes illegal the moment it is used to:

-

Conceal the Identity of the real owner (Beneficial Owner).

-

Launder Money or “layer” funds to hide their criminal origin.

-

Avoid Tax through fraudulent artificial structures.

2. New 2025/2026 Penalties: The Cost of Being a “Front”

Under the Corporate Service Providers Act 2024 (effective June 2025), the stakes for “Nominee Directors” and company owners have reached an all-time high.

-

Criminal Liability: If you are a director of a shell company used for scams or laundering, you can face up to 10 years in prison and fines of up to S$500,000—even if you claim you “didn’t know” what the company was doing.

-

Blacklisting: ACRA and the Police have already begun blacklisting and freezing the assets of companies linked to fugitives and suspicious networks.

-

Professional Barring: Directors found negligent can be disqualified from holding any directorships in Singapore for up to 5 years.

3. Why Banks Are Closing “Quiet” Accounts

Even if your intentions are 100% legal, a “quiet” company with no employees and no physical office (Economic Substance) is now a high-risk target for banks.

Since the 2023 crackdown, Singapore banks are performing continuous monitoring. If your company has no “economic pulse” but suddenly receives a large transfer, the bank is legally obligated to file a Suspicious Transaction Report (STR) and may freeze your funds instantly.

4. How to Stay Legitimate

To avoid being flagged as a high-risk shell company, follow these compliance pillars:

-

Maintain a Register of Controllers (RORC): You must disclose the natural person who ultimately owns the company. Hiding behind layers of offshore firms is no longer an option.

-

Declare Nominee Arrangements: As of June 2025, all nominee director arrangements must be reported to ACRA.

-

Appoint a Registered CSP: Ensure your Corporate Service Provider is ACRA-registered like Excellence Singapore. Using unregistered “underground” agents is a fast track to an investigation.

Conclusion: Transparency is Your Best Asset

The era of “hiding” in Singapore is over. The regulators have made it clear: Singapore is open for business, but it is closed to those who use shell companies as a mask.

At Excellence Singapore Group, we ensure your company structure is transparent, compliant, and ready to pass any bank or ACRA audit.

Worried about your company’s compliance status? Contact us for a 2026 Compliance Health Check